When considering vision correction procedures (like LASIK, SMILE, Refractive Lens Exchange (RLE) and more) in Phoenix, Mesa, and surrounding Arizona communities, affordability is often a significant factor. As elective procedures, the out-of-pocket expense might seem daunting (though the lifetime savings and lifestyle enhancements are worth the investment!) Many people don’t realize that Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) can make these life-changing procedures much more accessible. These accounts are powerful financial tools designed to help you cover medical expenses, including eligible vision correction procedures. Let’s break down what FSAs and HSAs are, how they work, and why using them for vision correction before the end of the year is a smart move.

What is an FSA?

A Flexible Spending Account (FSA) is a pre-tax benefit account provided through your employer. It allows you to set aside a portion of your paycheck to pay for eligible medical, dental, and vision expenses. By contributing to an FSA, you reduce your taxable income, which can save you money in the long run.

However, there’s one key limitation: FSA funds are “use-it-or-lose-it.” Most Flexible Spending Accounts require you to spend your balance by December 31 each year, or you risk losing the unused funds. Some employers offer a grace period or allow a small rollover amount (e.g., $500), but it’s crucial to confirm the specifics of your plan.

What is an HSA?

A Health Savings Account (HSA) is another type of tax-advantaged account that allows you to save and pay for qualified medical expenses. Unlike an FSA, an HSA is tied to high-deductible health plans (HDHPs). These accounts offer greater flexibility because unused funds roll over from year to year, and the account stays with you even if you change jobs or retire.

HSAs also have an investment component, allowing you to grow your savings tax-free over time. This makes HSAs a valuable tool for both current and future medical expenses, including vision correction procedures.

How Can FSA & HSA Funds Be Used for Vision Correction?

Both FSA and HSA funds can be applied to many vision correction procedures, including:

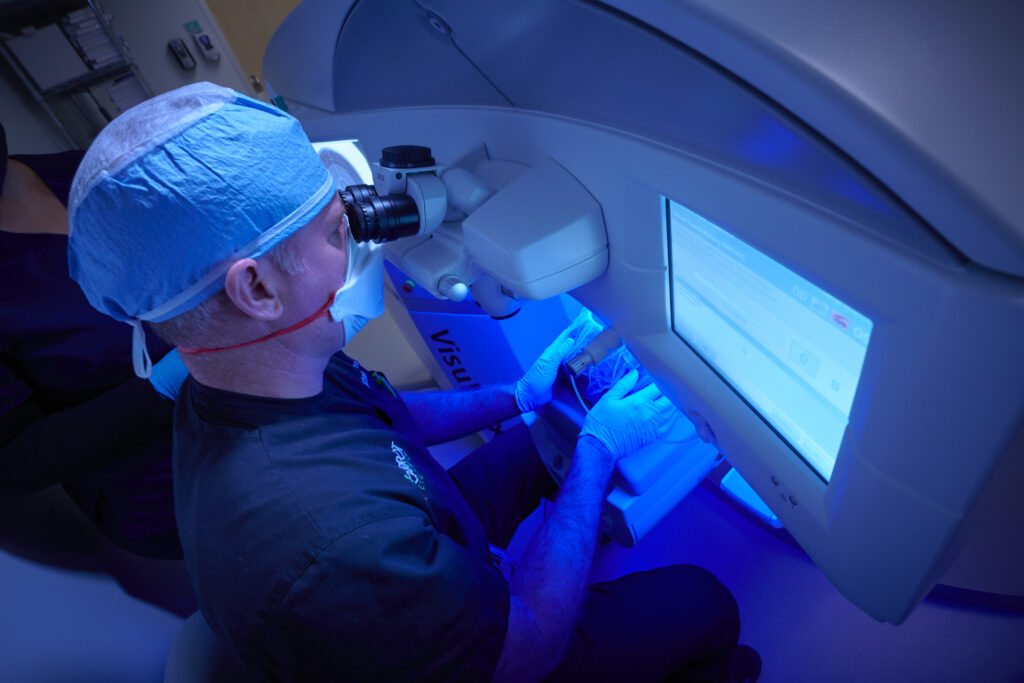

– LASIK: Corrects nearsightedness, farsightedness, and astigmatism.

– PRK: An alternative to LASIK, ideal for patients with thinner corneas.

– SMILE: A minimally invasive laser vision correction option.

– Refractive Lens Exchange (RLE): Addresses presbyopia and eliminates the need for future cataract surgery.

These procedures are considered qualified medical expenses, making them eligible for payment with FSA or HSA funds. Using these accounts can significantly reduce your out-of-pocket costs by allowing you to pay with pre-tax dollars.

Timelines and Deadlines

For FSA Users: Most FSAs require you to spend your funds by December 31. If you’ve been considering vision correction, now is the time to schedule your procedure to ensure your dollars don’t go to waste.

For HSA Users: While there’s no end-of-year deadline, using your HSA funds now for vision correction can free up future savings for other medical expenses or allow your account to grow tax-free. It’s also the perfect time to claim crisp, clear vision before the holidays – see the holiday lights, family table and gift-opening celebrations like never before!

Why Use Your FSA or HSA for Vision Correction?

- Maximize Your Tax Savings: FSA and HSA funds are pre-tax, meaning you save money by avoiding income taxes on the amount you use for eligible medical expenses.

- Invest in Yourself: Vision correction procedures improve your quality of life by reducing or eliminating your dependence on glasses or contact lenses.

- Use It Before You Lose It: If you have an FSA, the end of the year is your last chance to spend those funds. Don’t let them go to waste when they can be used to invest in better vision.

- Plan for the New Year: Starting the new year with clear vision sets the stage for a more confident, hassle-free lifestyle.

Clarity & Confidence Await – Contact Carrot LASIK & Eye Center to Start Your Journey to Vision Correction!

If you’re ready to make the most of your FSA or HSA dollars, now is the perfect time to schedule a consultation. Vision correction procedures are a long-term investment in your health, confidence, and overall quality of life. Reach out to the Carrot team today to learn more about your options and lock in your procedure before the year ends.

Take control of your vision—and your health—while maximizing the benefits of your FSA or HSA. Clearer vision is just one decision away! Schedule your consultation HERE.